Where

Relationships

Build Value

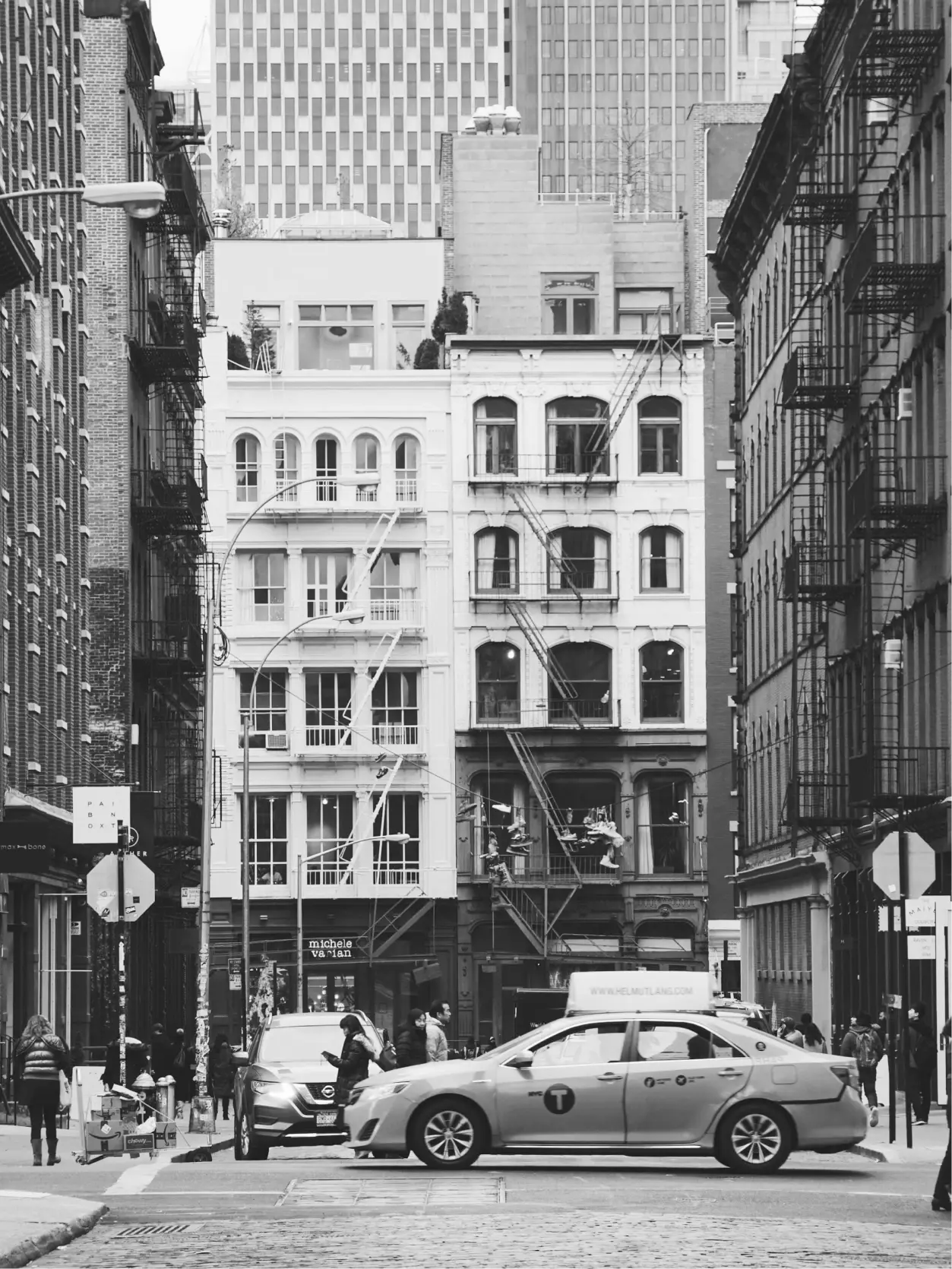

JEMM Capital Partners is a commercial real estate investment firm based in New York.

About

Our Firm

JEMM Capital Partners (“JCP”) is a commercial real estate investment firm founded to strategically capitalize on unique credit opportunities. The firm focuses on customized investments across the capital stack, including A/B loans, mezzanine loans, and preferred equity in stabilized, transitional, and development projects.

JCP employs a comprehensive investment approach, evaluating opportunities from both macro and micro perspectives to deliver attractive risk-adjusted returns. The team’s long-standing relationships with owners, developers, and lenders—built on trust, flexibility, and reliability—enable it to source and execute distinctive opportunities that align with the best interests of its investors. JCP’s investors include high-net-worth individuals, family offices, and corporations.

Recent

Transactions*

Our

Advantage

Experience

Led by industry veterans averaging over 20 years of experience, JCP’s leadership has collectively managed $30 billion in transactions across market cycles with consistent performance. Their expertise spans capital markets, financing, development, construction management, and direct investments. This experience facilitates our ability to provide tailored capital solutions to borrowers and bespoke opportunities to investors at an attractive risk-adjusted return.

Relationships

Responsiveness, flexibility, and integrity are the foundation of our deep network of trusted partners, lenders, borrowers, and brokers.

Execution

We seek to deliver ease of execution through customized capital structures, certainty of execution, and transparency.

Executive

Team

Loan

Criteria

- 1

Loan Amounts

$1–$100 million

- 2

Property Types

Commercial and Residential

- 3

Interest Rates

Fixed and Floating

- 4

Terms of Loan

Flexible

- 5

Loan Types

Stabilized, Transitional, Land and Construction

- 6

Loan to Value

Up to 85%

- 7

Locations

Tri-state area and major US markets